Bass Pro Shops has agreed to acquire Cabela’s for $5.5 billion, combining two of the most well-known retailers for hunting and fishing gear according to the NY Times and USA Today.

It was not immediately clear whether the acquisition would result in any store closures, but the companies said in a statement that Springfield, Mo.-based Bass Pro Shops would “celebrate and grow” the Cabela’s brand.

Bass Pro Shops — which remains privately held, largely by Johnny Morris, who started the company 45 years ago in his father’s liquor store near Springfield, Mo. — plans to purchase Cabela’s for about $65.50 a share in cash, according to a statement on Monday. Cabela’s said on Dec. 1 that it was exploring strategic alternatives. The takeover price represents a 40 percent premium to where its shares were trading that day.

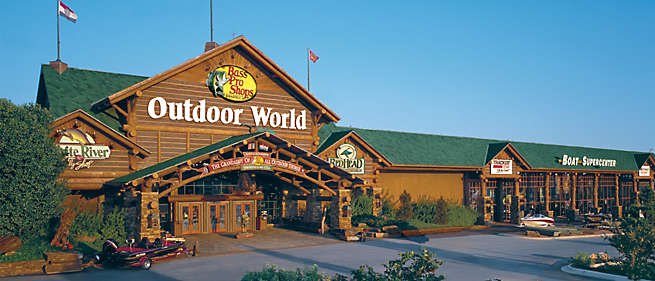

The deal marries Cabela’s 19,000 employees with Bass Pro Shop’s 20,000, and adds 85 Cabela’s stores to Bass Pro Shops’ 99. Bass Pro Shops also operates the White River Marine Group, which makes fishing boats.

“Today’s announcement marks an exceptional opportunity to bring together three special companies with an abiding love for the outdoors and a passion for serving sportsmen and sportswomen,” said Mr. Morris, the chief executive of Bass Pro Shops. “The story of each of these companies could only have happened in America, made possible by our uniquely American free enterprise system.”

Mr. Morris will continue as chief executive and majority shareholder of the company, which will be privately held.